Vanguard 500 Index Fund Investor Shares ( VFINX ) and Vanguard 500 Index Fund ETF ( VOO ) are two of the most popular investments this year, and many investors want to find out which one is better. But let me tell you something fundamental here – VFINX is a mutual fund, whereas VOO is an ETF.

VOO tracks the performance of its benchmark index – S&P500, and it employs an indexing investment approach. The Fund attempts to replicate the S&P500 by investing all of its assets in the stocks that make up the Index with the same approximate weightings as the Index.

In my research, VOO is better because it’s cheaper than VFINX and provides better returns ( a mutual fund never outpace the market ). With VOO, you can use stop orders, limit orders, and short selling just like a regular stock. In comparison, with VFINX, you can’t do that at all. Also, keep in mind that you need at least $3K to invest in VFINX; in comparison, you can buy just 1 share of VOO at the current price ( $378, at the time of writing this ).

In a glance:

| VFINX | VOO | |

| Security Type | Mutual Fund | ETF |

| Segment | U.S. Equity: Large Blend | Equity: U.S. – Large Cap |

| Issuer | Vanguard | Vanguard |

| Net Assets | $215.38B | $205.58B |

| Expense Ratio | 0.14% | 0.03% |

| Management Style | passive (index-based) | passive (index-based) |

| Dividend Yield | 1.32% | 1.04% |

| YTD Return | 11.55% | 12.70% |

| 1-Year Return | 48.14% | 49.70% |

| 5-Year Return | 98.49% | 100.47% |

| Since Inception | 187.08% | 350.08% |

| Our Rating ( 1-10 ) | 8 | 10 |

Table of Contents

What Are The Differences

So the biggest difference between VFINX and VOO is that the first is more expensive because it’s a mutual fund, and the latter is an ETF. They have a lot in common, but ETF’s can be traded like stocks, while mutual funds only can be purchased at the end of each trading day. Fund managers actively manage VFINX rather than passively tracking an index. ETFs are more tax-efficient and much more liquid than mutual funds.

Vanguard 500 Index Fund ETF ( VOO ) is more widely available to trade from a larger number of investment websites and apps. VFINX on the other hand is available only on Vanguard’s website. That might be a deal-breaker for you, if you don’t want to leave your favorite investing app.

Read more: All Stocks That Pay Dividends in 2021

VFINX vs. VOO – The Returns

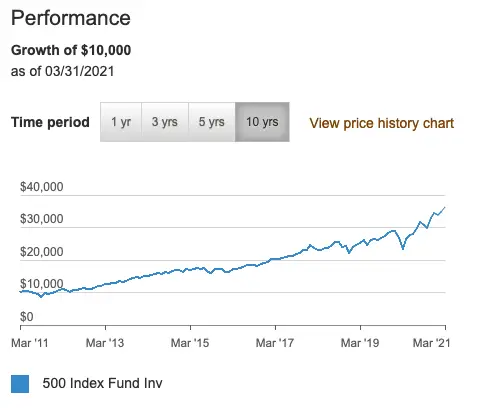

VFINX has a lower 5-year return than VOO (17.17% vs 17.28%), but because of the lower expense ratio of VOO, you might get a better long-term return.

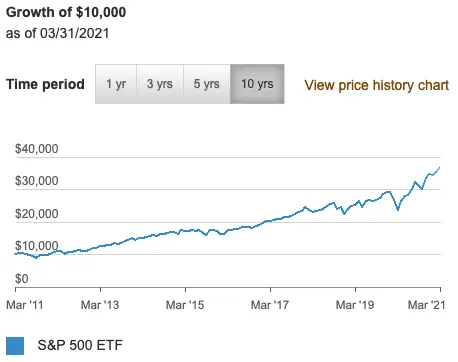

Growth of $10k invested in VOO

Growth of $10k invested in VFINX

The Required Minimum

You can buy VFINX if you can invest $3,000 minimum. In comparison, you can invest in VOO at the current price of 1 share. If 1 VOO share costs $378 – then the minimum to invest is $378. Simple as that.

Fund Holdings

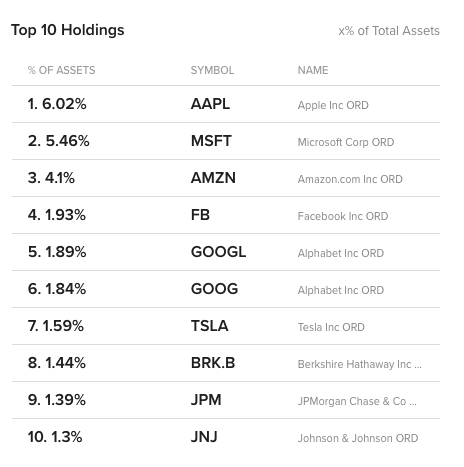

The biggest holdings in VOO are Apple Inc with 6.02%, Microsoft Corp with 5.46%, Amazon.com Inc with 4.1%, etc. Below you can see a more detailed breakdown of the top 10 holdings.

The situation is very similar with the VFINX:

Read more: