Investing in the stock market is probably the best way to increase your net worth over time and a straightforward way to make at least $50K per year from your home. Most experts agree that the best way to invest in the stock market is to put your hard-earned money into a broad market index fund.

Table of Contents

The SPX is just a stock index comprised of the 500 larges U.S publicly traded companies by market capitalization listed on the NYSE or NASDAQ. The size of the index is determined by share price multiplied by the number of outstanding shares. On the other hand, SPY is the ticker of SPDR S&P 500 ETF, one of the most popular exchange-traded funds worldwide.

The reality is that you can’t buy SPX as a single stock. Instead, you can buy one of the hundreds if not thousands of ETFs based on it. The only way to trade the SPX itself is thru option trading – not the best way to start investing if you’re a beginner.

Read more: All Stocks That Pay Dividends in 2021

If you’re into options trading, remember that SPY options are American style and may be exercised at any time after you bought them. SPX options, on the other hand, are European style which means that they can be exercised only at expiration.

| SPX |

| An index product ( no shares ) |

| European style (cash-settled) options |

| 60/40 tax treatment |

| Single exchange-traded |

| Price is tied to the S&P 500 index |

| Strike width of 5.00 (near month) |

| SPY |

| ETF that does trade shares |

| American style option |

| No special tax treatment |

| Pays a dividend |

| Traded on multiple exchanges |

| Price is 1/10th the S&P 500 |

What Returns to Expect

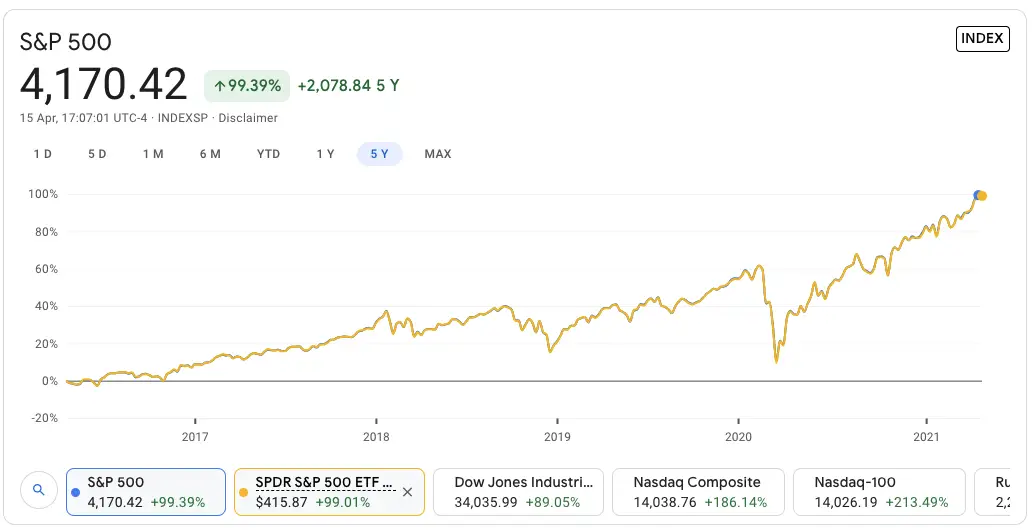

As we already clarified, the best way to invest in SPX ( S&P500 ) is through an ETF like the SPY. But what returns you should expect from a diversified large-cap U.S. index. Let’s find out.

SPDR S&P 500 ETF Returns

- YTD Return: 12.77%

- 1-Year Return: 49%

- 5-Year Return: 99.01%

- Since Inception: 846%

- Dividend Yield: 1.32%

What about historical annual returns of S&P500? Here’s a nice chart with the data since 1927.

SPY Holdings

The Conclusion

SPY is one of the best ways to participate in the broad stock market and increase your portfolio over time. To be frank, I personally invest almost 90% of my income in SPY stock. Even the experts can’t beat the market nowadays, so why risk it all on a small portfolio of individual shares.

Read more: