How to get over the psychological hurdle of self-doubt and fear that can take hold of anyone eager to leave the office and venture forth on the Internet to strive for an income of $50K annually?

Table of Contents

Take the advice of folks writing for Evergreen Dimes. They encourage folks to take the challenge down to its smallest denominator by doing the math.

Find the product or service 500 people are willing to spend $100 each on – or 10,000 people who will spend $5 each – and you’ve got an entire year to reach your goal.

But what are the top 10 ways to make $50K per year from home? Let’s find out.

1. Teach English Online

The demand for English teachers in China is overwhelming as that nation’s wealth rises and the desire to learn English grows in direct proportion to a shrinking globe “Though the industry is projected to exceed $100 billion in the future, the lack of quality teachers is a problem,” say researchers. Visit VipKids and explore this lucrative market. You are required to be a U.S. or Canadian resident and have a dependable internet connection to apply.

2. Invest in Real Estate

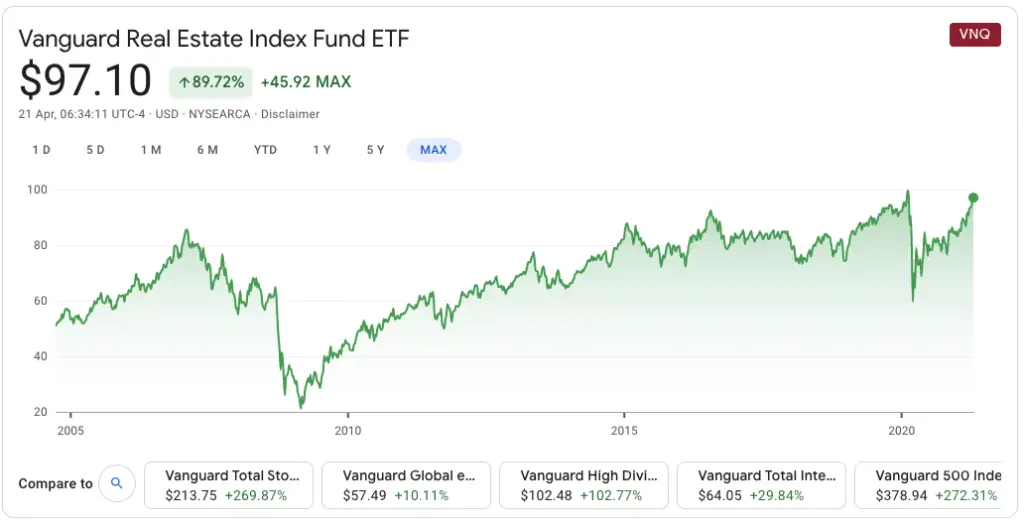

Nerd Wallet advises people who want to make $50K annually to consider five different conduits to reaching that goal. Whether your road to financial success comes from buying real estate investment trusts (REITs), mastering one or more online real estate investment platforms, invest in rental properties and flip them, or renting out one or more rooms, you may surpass your $50K goal before December rolls around.

Another way is the so-called driving for dollars – a driver who scopes out the distressed properties in a neighborhood and then sells the information to property flippers.

Read more: 8 Best Investments to Get Regular Monthly Income

3. Post a gig on Fiverr or UpWork

Industry experts estimate creative professionals can earn up to $200K annually if you’ve got what it takes to deliver on excellent copywriting, customer care, design, technical engineering, and skills that fit under this umbrella. One of the most popular conduits to finding a career you can undertake at home is UpWork where talented individuals can find their calling. A similar resource you may wish to check out is Fiverr.

Read more: How to Become a Millionaire Online

4. Start a YouTube Channel

Generating a healthy income via ad placements, sponsorships, fan funding, and sales was once a fairly simple process until content creators found ways to monetize their videos, say Investopedia.com experts. Generate 1,000 subscribers and amass 4,000 hours of watch time, and not only can you make $50K annually, but you could qualify for the YouTube Partner program where. Watch this awesome video below to learn more about how to make money on YouTube in 2021.

5. Invest Your Way to Success

The earlier you start the faster you’ll build your assets and portfolio, according to Investopedia where Jean Folger offers 5 of the best tips on time management, risk-taking, mastering online platforms, and a variety of other dynamic skills. Add to your understanding of this exciting career by reading R.L. Adams’ article published by Entrepreneur.com.

Read more: All Our Favourite Dividend Stocks

6. Launch an at-home therapy practice and counsel clients virtually

Covid’s arrival was devastating to counselors, psychologists, and therapists because face-to-face sessions weren’t possible. But this industry fared better than most by taking advantage of resources like FaceTime and Zoom. For professionals with the education, credentials, licenses, and certifications required to practice, the national average salary of $52,900 cited on Grow.com could be a drop in the bucket if you’re successful. Need help getting established? Visit this awesome resource for more great tips.

7. Become a Facebook Lead Generator or Ad Specialist

You may need some training to learn the ins and outs of either job title, but if you become adroit at selling packages that benefit local retailers who are not savvy about using Facebook, you can build a tidy career. Facebook ad specialists earn upwards of $53,000 on average and lead generator salaries are in that ballpark.

8. Be Smart About Managing Debt

It’s easy to start with a credit card, find more card offers in your mailbox, and build up a tidy collection of them. It’s hard to juggle all of these cards if you find yourself using all of them.

As of November 2020, Americans are carrying an average personal debt of $92,727.

There’s a logical method to paying them down and retiring some, writes LaToya Irby for TheBalance.com. There are two ways to do this expeditiously. Either prioritize paying down the card with the highest interest first or choose the card with the lowest balance, so you see progress fairly quickly in your quest to create a clean slate.

Read more: How Much to Spend on a Vacation

Is one better than the other? That depends upon your current circumstances, your mindset, and your commitment. Are there exceptions to either rule? Yes, writes Irby, and there are factors you must consider like having opted out of a rate increase, closed the card in question, or agreed to a deferred interest arrangement that you accepted in return for that benefit.

If you find yourself in a bind, it’s wise to contact a credit counselor or connect with a debt relief program to help you dig yourself out of this conundrum.

9. Negotiate a salary raise and/or job offer

If the timing isn’t right for you to launch your at-home career, negotiating a salary raise could be the answer to your current financial situation and obligations, or perhaps you’re ready for a new job where the grass is greener financially.

Indeed.com offers easy-to-follow steps for braving the waters and approaching your boss about a salary increase. Among these timely tips are:

-Honestly, assess your current geographic location, background, experience, education, skills, and credentials like licenses and certifications.

-Do enough homework to understand salary ranges in your area and for your unique talents and skills.

-Rehearse the ask. Whether it’s a raise or you want to stand out as the best candidate, emphasize your accomplishments, innovations, and industry knowledge.

-Make an appointment to have this meeting. This isn’t the time to drop in unannounced.

-Work on your self-confidence with a friend willing to be honest about how you’re coming across.

-When asked for the salary you seek, don’t start at the bottom of the bracket. A better place to start is at the range top knowing that negotiating is part of the process.

-Don’t be scared to walk away if your salary talk or interview is at a stalemate with no potential for improvement.

Read more: Where to Buy NFTs: Best NFT Marketplaces in 2022

10. Start an emergency fund

One of the traits found in people who are successful at what they do is that they save money for emergencies. Whether you intend to launch your at-home business right now or you’ve got a target date, having an emergency fund can mean the difference between making a go of your plans and watching them fall flat.

According to a majority of financial experts having between three and six months’ worth of expenses is the recommended amount for emergency funds to cover medical bills, major automobile breakdowns, and home emergencies like a broken HVAC system, flooding, or a roof torn off by a tornado.

Emergency funds are especially critical if you don’t have homeowners insurance, which your state may not mandate.

There are general rules associated with emergency funds that can’t be compromised. The fund must be monetized by a liquid account that enables you to withdraw funds without penalties or extended periods of time, which is why savings accounts at banks, savings and loans, or credit unions are the options of choice.

Miriam Caldwell’s inciteful article about the 8 reasons everyone needs an emergency fund for The Balance.com minces no words when she details sensible reasons everyone needs backup funds. Some people are especially vulnerable, and they include:

- Single income households

- One or more family members are self-employed contractors

- Homeowners with mortgage payments vulnerable to default

- Living far away from family or have no family upon which to fall back in a crisis

- At least one family member suffers from a medical condition that is serious enough to max out annual health plan limits.

What to do if you have no emergency fund

Desperation begets desperate actions, which is why the U.S. has become an epicenter for retail “quick cash” shops that prey on desperate people willing to promise anything to get money for an emergency, say analysts at Kiplinger.com.

There are alternatives if you want to avoid these high-interest loan sharks and while none of them are pretty they can bail you out until you recover from your current situation. For homeowners, Kiplinger recommends tapping a home’s equity by securing a home-equity line of credit (HELOC to bridge the gap. Since you’re borrowing your own money this makes the most amount of sense in a pinch.

A second option is to sell investments within your taxable account portfolio. Money manager David Wirth recommends “tapping short-term bonds because there is unlikely to be a significant taxable gain. If you decide to sell stocks or stock funds, stick with those that you’ve owned for more than a year so you’ll be taxed at the long-term capital gains rate.”

Option three is the most convenient way to dig out of a financial crisis: Use your credit card(s). If you were clever enough to apply for a 0-percent annual percentage rate card that has been set aside only for emergencies, you could incur only one transaction charge to get your hands on emergency cash.

Retirement accounts should be considered a last option because while you can withdraw from a Roth IRA at any time and not be penalized, traditional IRAs come with penalties associated with personal loans.

If your IRA happens to be tied to your current employment and you decide to quit your job to start an at-home business that is projected to earn you $50K annually, you’re going to have to repay any loan you may have taken or expect a call from the IRS.

Read more: