VFIAX ( Vanguard 500 Index Fund Admiral Shares ) and VTSAX ( Vanguard Total Stock Market Index Fund Admiral Shares ) are two of the most popular Vanguard index funds in 2021.

Table of Contents

VFIAX is the first index fund for individual investors. It’s a low-cost fund that offers exposure to the top 500 of the largest U.S. publicly traded companies. It’s considered core equity holding in a portfolio. It’s also available as an ETF – Vanguard S&P 500 ETF ( VOO ).

On the other hand, VTSAX ( Vanguard Total Stock Market Index Fund Admiral Shares ) is created in 1992 as a total stock market index fund that consists of small, mid, and large-cap growth and value stocks. VTSAX is also available as an ETF with a ticker VTI ( Vanguard Total Stock Market ETF ).

Read more: VFINX vs. VOO – Which Fund is Better? ( Comparison )

In a glance:

| VFIAX | VTSAX | |

| Security Type | Mutual Fund | Mutual Fund |

| Segment | U.S. Large Cap | U.S. Broad Market |

| Issuer | Vanguard | Vanguard |

| Net Assets | $739.5 billion | $1.2 trillion |

| Expense Ratio | 0.04% | 0.04% |

| Management Style | Passive | Passive |

| Dividend Yield | 1.39% | 1.29% |

| YTD Return | 12.62% | 12.70% |

| 1-Year Return | 35.34% | 38.94% |

| 5-Year Return | 109.18% | 112.30% |

What Are The Differences Between VFIAX and VTSAX

The biggest difference between the two mutual funds is that VFIAX offers 500 of the largest U.S. companies in many different industries and sectors. In contrast, VTSAX offers exposure to the entire U.S. equity market, including small-, mid-, and large-cap. VTSAX is considered one of the broadest mutual funds in the United States. VTSAX is older than VFIAX thus has grown to bigger total net assets of $1.2 trillion vs. $739.5 billion for VFIAX.

Read more: All Stocks That Pay Dividends in 2021

VFIAX vs. VTSAX – Which Offers Better Returns

Both funds show very similar results in the last 5 years, but also when we compare them YTD. Generally speaking, VTSAX could offer a bit better return because it offers exposure to small and mid-cap companies that sometimes grow faster.

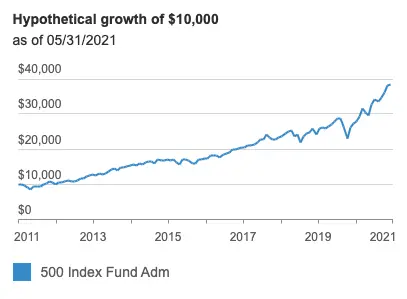

Growth of $10k invested in VFIAX

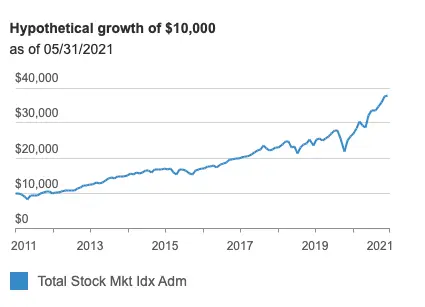

Growth of $10k invested in VTSAX

The Required Minimum

Both VFIAX and VTSAX have a required minimum of $3000. If you want to invest a smaller amount, you should probably check the ETF equivalents VOO for the VFIAX, and VTI for the VTSAX.

Funds Holdings

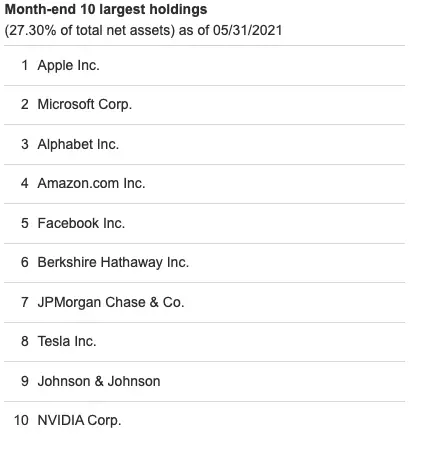

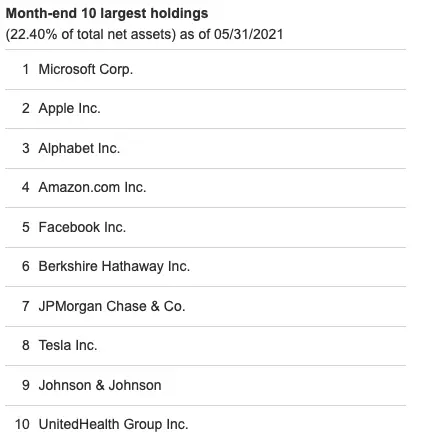

The biggest holdings in both funds are Apple Inc. Microsoft Corp. and Alphabet Inc., followed by Amazon.com Inc., Facebook Inc., and Berkshire Hathaway Inc..

VFIAX Top 10 Holdings

VTSAX Top 10 Holdings

Conclusion

Both VFIAX and VTSAX are excellent low-cost mutual funds for anyone who wants to invest in the broad market without picking individual stocks. They are both available in ETFs if you prefer a 100% passively managed fund, as they typically track a specific market index.

Read more: